11/04/2023

It was a tough pandemic with the shopping centre sector generally having to endure a lot; prolonged closures have created a financial squeeze only to be compounded by an economic recession. With consumers moving online, questions have been raised about whether the classic shopping centre, an essential part of the modern European retail landscape, is in decline. Not the case, according to recent research from the team at RegioData.

RegioData, a market research firm providing regional economic data to the retail and real estate industry, presents its latest analysis on the health of the European shopping centre industry. The team, together with its sister company, RegioPlan Consulting, a consultancy firm providing advice to the real estate and retail professionals in the public and private sector on location and investment decisions, are affiliated partners of ECSP.

Europe still loves to go shopping. When it comes to visiting retail places to spend their money, to buy the things they need and want, shopping centres continue to dominate consumer choices. This is set to remain the case, at least for the medium term. A phased-out model? We don’t think so.

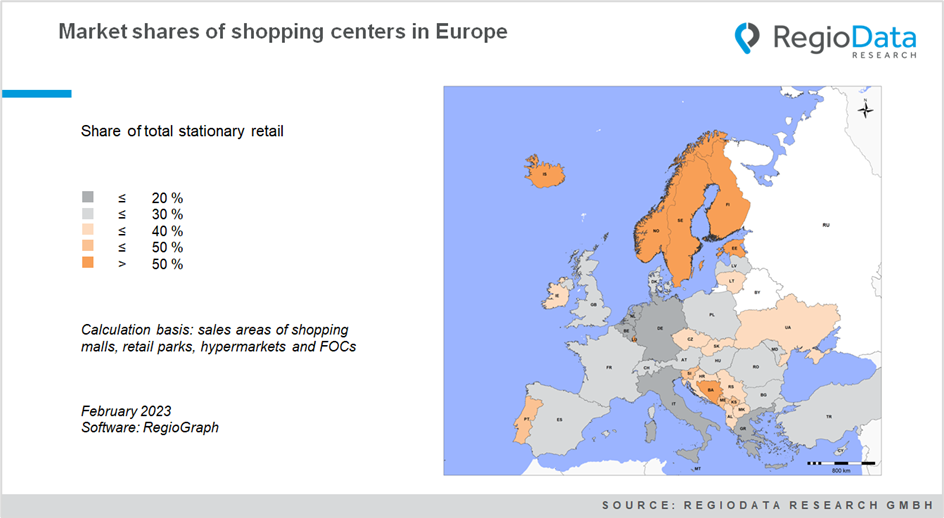

But the extent of this dominance varies considerably, ranging from a whopping 63% in Iceland to a meager 8% in Greece. For the first time we have mapped the market share of total stationary retail trade in every European country based on our current database which comprises over 12,000 centres.

Grab your coat, we’re going shopping!

Unsurprisingly, the colder the weather, the higher the provision of shopping centres. Looking at Figure 1 from our research below, it is apparent that northern Europe is well-covered. In some parts of Central Europe, access is significantly lower. In South-Eastern European countries, provision has increased – with a considerable number of large new shopping centres opening – and will probably continue to do so. Climate, urban landscape, legislation, and purchasing power are the main factors influencing these differences.

Iceland tops the league table. Estonia takes second place with just under 55%, and Norway third with 53%. Luxembourg and Sweden are also in the top 5 with just over 50%, mainly due to the northern weather conditions and the often smaller and less retail-oriented city centres. In Northern Europe, shopping centres have unusually large sales areas; sizes of over 60,000 m2 are not uncommon.

Bucking the trend: Italy and Germany

While the growth in shopping centres floorspace is booming in some countries, the trend is stagnant in other parts of Europe. Italy and Germany, in particular, have a lower proportion of shopping centers in terms of overall floor space. With a national sales area of just under 125 million m2, shopping centers in Germany account for only about 15.6% of this. In Italy, the shopping center share is 17%. In both countries, inner-city shopping streets dominate the existing sales areas.

The highflyers: The Balkans

The high-flyer of the current shopping center outlook is the Balkan region. Here, the market shares of shopping centers are rising continuously, especially in Bosnia and Herzegovina. At just under 47%, Bosnia holds the eighth-largest shopping center market share in Europe, placing it close behind the Scandinavian countries. The high figure is partly due to the expansion policy of the Bingo chain: the company is considered the country’s top-selling food company and is thus the market leader. Now Bingo is even said to be implementing shopping center projects totalling over 200,000 m2. Secondly, apart from the capital city Sarajevo, there are hardly any established shopping streets to satisfy people’s purchasing needs.

The development in the Balkan region is somewhat reminiscent of the turn of the millennium, especially in Romania and Poland, where high dynamics of shopping centers occurred, yet the purchasing power was still low. Thus, the high shopping center market shares in the Balkan region and the current expansion projects are risky, given the current purchasing power.

To summarise, in a nutshell, Europe is not homogenous. It’s a patchwork of different levels of provision, spending power and new opportunities. The economic downturn may dampen appetite for new development in those markets where consumers are already well provided for, but other opportunities exist elsewhere, particularly in the South and East, irrespective of whether the sun is shining or not.

For copies of the research and for more information on RegioData Research GmbH please go to https://www.regiodata.eu/en/europe-major-differences-in-the-market-shares-of-shopping-centers/